All Categories

Featured

Table of Contents

If you are a non-spousal beneficiary, you have the choice to place the money you acquired right into an inherited annuity from MassMutual Ascend! Inherited annuities might provide a way for you to spread out your tax obligation, while enabling your inheritance to proceed expanding.

Your choice might have tax obligation or various other repercussions that you might not have actually taken into consideration. To assist prevent shocks, we recommend chatting with a tax advisor or an economic specialist prior to you choose.

Is an inherited Fixed Income Annuities taxable

Annuities do not constantly adhere to the very same regulations as other possessions. Lots of people transform to annuities to benefit from their tax obligation advantages, as well as their one-of-a-kind capacity to aid hedge versus the economic threat of outlasting your cash. When an annuity owner passes away without ever having annuitized his or her plan to pay normal earnings, the person named as recipient has some crucial decisions to make.

Allow's look much more carefully at exactly how much you have to pay in tax obligations on an inherited annuity. For the majority of kinds of property, income tax obligations on an inheritance are rather easy. The typical case entails assets that are qualified wherefore's understood as a step-up in tax basis to the date-of-death value of the acquired property, which efficiently eliminates any type of integrated capital gains tax responsibility, and offers the successor a fresh start versus which to measure future earnings or losses.

How are beneficiaries taxed on Joint And Survivor Annuities

For annuities, the secret to taxes is just how a lot the departed individual paid to buy the annuity agreement, and just how much money the deceased person obtained from the annuity prior to fatality. IRS Magazine 575 states that, in general, those inheriting annuities pay tax obligations the very same way that the original annuity proprietor would certainly.

Because case, the taxes is much easier. You'll pay tax obligation on whatever over the cost that the initial annuity proprietor paid. The quantity that represents the initial premium payment is dealt with as tax obligation basis, and therefore left out from taxable earnings. There is a special exception for those that are entitled to get guaranteed settlements under an annuity contract. Annuity income riders.

This turns around the typical regulation, and can be a big advantage for those inheriting an annuity. Inheriting an annuity can be extra complex than receiving various other residential or commercial property as a successor.

We 'd like to hear your inquiries, ideas, and viewpoints on the Understanding Center in general or this page in certain. Your input will certainly aid us assist the world invest, far better!

Fixed Income Annuities and inheritance tax

When an annuity owner passes away, the staying annuity value is paid out to individuals who have actually been named as recipients. Period certain annuities. The survivor benefit can produce a monetary windfall for recipients, but it will certainly have numerous tax obligation ramifications depending upon the kind of annuity and your recipient status. The tax obligation you pay on annuity death advantages depends upon whether you have a qualified or non-qualified annuity.

If you have a non-qualified annuity, you won't pay revenue taxes on the payments section of the circulations considering that they have actually already been exhausted; you will only pay revenue tax obligations on the revenues section of the circulation. An annuity fatality advantage is a form of repayment made to an individual determined as a recipient in an annuity agreement, usually paid after the annuitant passes away.

The beneficiary can be a youngster, spouse, moms and dad, and so on. If the annuitant had started receiving annuity settlements, these repayments and any type of appropriate costs are subtracted from the death earnings.

In this instance, the annuity would certainly offer a guaranteed death advantage to the beneficiary, no matter the remaining annuity balance. Annuity survivor benefit are subject to income tax obligations, but the tax obligations you pay depend upon just how the annuity was fundedQualified and non-qualified annuities have various tax ramifications. Qualified annuities are moneyed with pre-tax cash, and this suggests the annuity proprietor has not paid taxes on the annuity payments.

Non-qualified annuities are moneyed with after-tax dollars, meanings the payments have actually already been tired, and the money will not be subject to revenue tax obligations when dispersed. Any incomes on the annuity payments grow tax-deferred, and you will pay earnings tax obligations on the profits part of the distributions.

Are Annuity Death Benefits death benefits taxable

They can choose to annuitize the contract and get routine payments with time or for the remainder of their life or take a round figure repayment. Each payment option has various tax ramifications; a round figure payment has the highest possible tax repercussions considering that the repayment can push you to a greater income tax obligation brace.

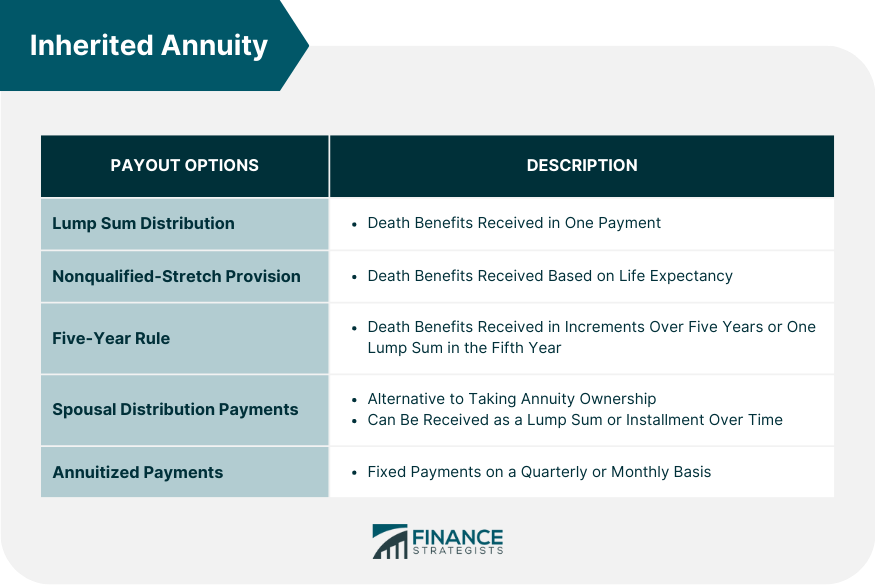

You can also make use of the 5-year rule, which allows you spread out the acquired annuity payments over five years; you will certainly pay tax obligations on the circulations you obtain yearly. Beneficiaries acquiring an annuity have several choices to get annuity repayments after the annuity owner's fatality. They consist of: The recipient can choose to receive the continuing to be value of the annuity contract in a single round figure repayment.

This alternative utilizes the recipient's life span to establish the size of the annuity payments. It provides annuity repayments that the beneficiary is entitled to according to their life span. This guideline needs recipients to take out annuity payments within five years. They can take multiple payments over the five-year period or as a single lump-sum settlement, as long as they take the full withdrawal by the fifth wedding anniversary of the annuity proprietor's death.

Here are points you can do: As an enduring partner or a deceased annuitant, you can take ownership of the annuity and continue appreciating the tax-deferred status of an inherited annuity. This allows you to avoid paying taxes if you maintain the cash in the annuity, and you will only owe revenue taxes if you obtain annuity payments.

The 1035 exchange just applies when you exchange comparable annuities. For instance, you can trade a qualified annuity for another certified annuity with much better features. However, you can not exchange a qualified annuity for a non-qualified annuity. Some annuity contracts offer special riders with an improved survivor benefit. This benefit is a benefit that will be paid to your recipients when they acquire the staying balance in your annuity.

Table of Contents

Latest Posts

Analyzing Variable Vs Fixed Annuity Key Insights on Annuities Variable Vs Fixed Defining Fixed Vs Variable Annuity Pros Cons Features of Fixed Vs Variable Annuity Why Pros And Cons Of Fixed Annuity An

Decoding Fixed Vs Variable Annuity Pros And Cons Everything You Need to Know About Financial Strategies Defining Fixed Income Annuity Vs Variable Growth Annuity Advantages and Disadvantages of Annuiti

Exploring the Basics of Retirement Options Everything You Need to Know About Choosing Between Fixed Annuity And Variable Annuity Defining the Right Financial Strategy Features of Retirement Income Fix

More

Latest Posts